The forex market operates 24 hours a day, five days a week, making it one of the most flexible trading platforms available. One crucial aspect of trading is understanding the various trading times and how they can affect your strategies. To maximize your trading potential, it’s helpful to know when the market is most active and how different time zones impact trading activities. For those looking for reliable trading options, forex trading times Forex Brokers in Uganda can provide essential insights and opportunities.

What Are Forex Trading Times?

Forex trading times refer to the hours during which you can buy and sell currencies in the global marketplace. Unlike stock markets that have fixed trading hours, the forex market is decentralized and operates continuously during weekdays. This flexibility is one of the key advantages of forex trading, allowing traders to participate in the market based on their schedules.

Understanding the Forex Market Sessions

The forex market is divided into four main trading sessions based on major financial centers around the world: Sydney, Tokyo, London, and New York. Each session has its unique characteristics, trends, and trading volumes.

- Sydney Session: The forex market begins in Sydney, Australia. The session starts at 10 PM GMT and ends at 7 AM GMT. It is generally quieter compared to other sessions as major financial news is often limited during this time.

- Tokyo Session: Following Sydney, the Tokyo session opens at 12 AM GMT and closes at 9 AM GMT. This session is known for its volatility, particularly with the Japanese yen, as news from Japan influences market movements.

- London Session: The London session is often the most active and important, starting at 8 AM GMT and ending at 5 PM GMT. It overlaps with both the Sydney and New York sessions, leading to increased trading volume.

- New York Session: The New York session opens at 1 PM GMT and closes at 10 PM GMT. It is another period with high volatility as trading activity peaks during overlaps with London.

Importance of Knowing Trading Times

Understanding forex trading times is crucial for several reasons:

- Volatility: Certain sessions experience higher volatility, leading to more trading opportunities. For example, the overlap between the London and New York sessions is often characterized by substantial price movements.

- Liquidity: Higher trading volumes during specific sessions generally lead to better liquidity. This means that trades can be executed quickly, and spreads may be tighter, reducing trading costs.

- Market News: Economic reports and news releases can impact currency values. Being aware of when such announcements occur helps traders plan their strategies accordingly.

How to Optimize Your Trading Based on Forex Times

To enhance your trading efficiency, consider these strategies:

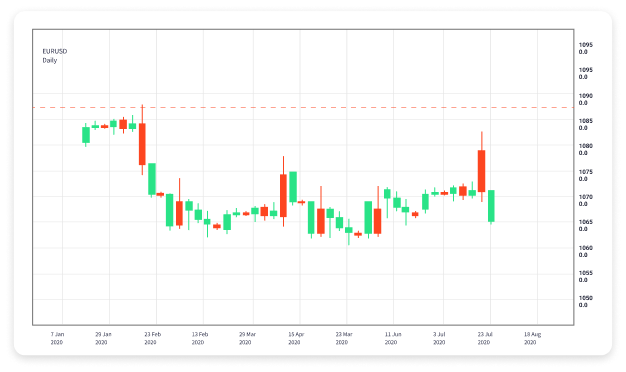

- Trade During Active Sessions: Focus your trading efforts during the most active sessions for your currency pairs. For instance, if you are trading EUR/USD, you might find the best opportunities during the London session when both European and American traders are active.

- Plan Your Trading Around News Releases: Schedule your trades around important economic reports such as employment data, inflation rates, and central bank meetings. Use an economic calendar to track these events.

- Set Trading Goals: Define what you aim to achieve in each session, whether it’s a specific profit target or a desired level of risk. Establishing clear goals will help maintain focus.

Common Mistakes to Avoid

While trading during the forex market’s active hours can be beneficial, there are common mistakes to avoid:

- Ignoring Time Zones: Always be mindful of the time zone differences, especially when planning to trade with counterparts from different regions.

- Overtrading: Just because the market is open doesn’t mean you need to trade continuously. Stick to your trading plan and avoid impulsive decisions.

- Neglecting Risk Management: Always implement risk management strategies regardless of how favorable the trading conditions may seem during specific times.

Conclusion

In conclusion, understanding forex trading times is essential for any trader looking to thrive in this dynamic and fast-paced market. By familiarizing yourself with the different trading sessions, recognizing when the market is most active, and planning your strategies accordingly, you can significantly enhance your trading performance. Always remember to stay updated with global economic events that might impact currency movements and be adaptable in your approach. With these insights, you can navigate the forex market more effectively.